New and inexperienced traders tend to spend most of their time researching technical analysis techniques or trying to refine the best entry and exit techniques. Whilst entries and exits are important they aren't nearly as important as risk management. This is the area initially most overlooked by novice traders and sooner or later it will rear it's ugly head when a position goes into or loss or drawdown situation. Having the courage to deal with a loss and accept it is extremely difficult for a lot of traders and a bad situation can very quickly become an account threatening disaster unless action is taken.

When things go wrong and the market seems to be conspiring against you ACTION MUST BE TAKEN..... using the 'hope' strategy and hoping price action will eventually go your way can lead to catastrophic draw downs on your account equity. If you've been trading for a while ask yourself how much you could of saved if you had cut your losing positions a lot sooner than you did....

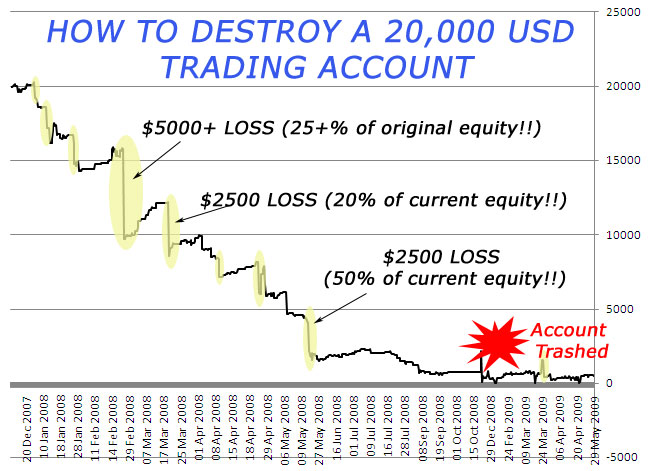

The equity curve below is real - it shows what happens to a 20k USD account when risk isn't managed properly. This is a good example of the 'hope' strategy going horribly wrong!

Request Product Data Sheet

The trader lost over half the account equity in just 3 trades! That's 10,000 USD!! If the trader had set a 2% maximum loss using the Zeus Risk Controller the total loss for these 3 trades would have been:-

2% X 15,000 = $300 +

2% X 12,500 = $250 +

2% X 5,000 = $100 = ONLY $650.

$650 LOSS

OR

$10,000 LOSS

Take your pick!

The Zeus Risk Controller would have preserved $9,350 in account equity and given the trader a fighting chance of keeping the account alive.

Don't let this happen to you!

Features

FX AlgoTrader's "Zeus Risk Controller" (Zeus) is an expert advisor (EA) which continuously monitors the MT4 Trade terminal for single or aggregated orders which exceed a trader defined maximum risk threshold.

Zeus has four operational modes which are:-

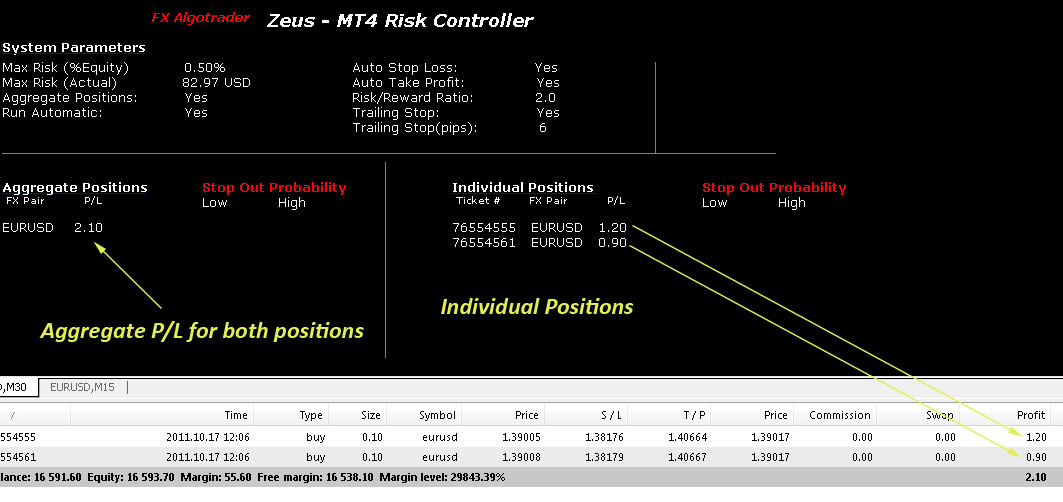

| Fully automatic with Aggregation | Zeus will monitor and automatically aggregate the profit/loss and order swap values for pairs with multiple orders. Eg. If the aggregated loss for all EURUSD positions is greater than say 2% of the current account equity the system will automatically close all the positions. |

| Fully automatic without Aggregation | Zeus monitors all trades individually and will automatically close any individual trade if the position loss is greater than x% of the account equity. (The risk is of course trader defined) |

| Manual with Aggregation | Zeus will automatically aggregate the order profit/loss and orderswap values for a given pair. Eg if the aggregated loses for all GBPUSD positions is greater than 1% of account equity the system will alert the trader and prompt for confirmation. If the trader decides to close the positions he/she clicks "Yes' in the messagebox and Zeus will automatically close all the GBPUSD positions on the trader's behalf. |

| Manual without Aggregation | Zeus will constantly monitor all positions individually. If the order profit/loss and combined swap values exceed the maximum trader defined loss Zeus will prompt the trader with the order number, symbol data and ask the trader whether he/she wants to close the position. If the trader clicks "Yes" the position will be closed on the trader's behalf. |

Additional Features:-

| Fully Automated Operation with Manual Overide | Zeus can be configured to run in a fully automated mode or can be manaully overidden by the trader. |

| Trader Definable Maximum Risk | The trader can precisely define the maximum risk as a percentage of account equity. |

| Voice Synthesized Alerts System | Zeus uses a proprietory voice synthesis algorithm to provide as much information as possibe to the trader in the most expedient way. The voice synthesis system ensures the trader is kept completely up to date with all system based order management processes. |

| Auto Stop Loss Facility | The "Auto_SL" feature will automatically instruct Zeus to set a hard stop loss level (SL) when new orders are executed. The stop loss will be calculated based on the maximum risk parameters defined in Zeus' external inputs. This facility provides an important safety feature in the event of a communication failure between the local MT4 client and the broker's server or a power outage. The trader can be comfortable in the knowledge that there are no naked orders on the broker's trade server which could cause devastating losses and potential margin calls |

| **NEW** - Trailing Stop Function | Traders can set a trailing stop for trades monitored by Zeus |

| **NEW** - Exclusion parameters for FX AlgoTrader Stat Arb Trades | Traders can exclude FX AlgoTrader stat arb trades from being managed by Zeus |

Customer Testimonial"I just wanted to write a review of Zeus for you as it saved my neck today - I have discipline issues! |

Zeus - MT4 Risk Controller |

Perpetual License (One Time Fee) with free Technical Support |

$64.95 USD |

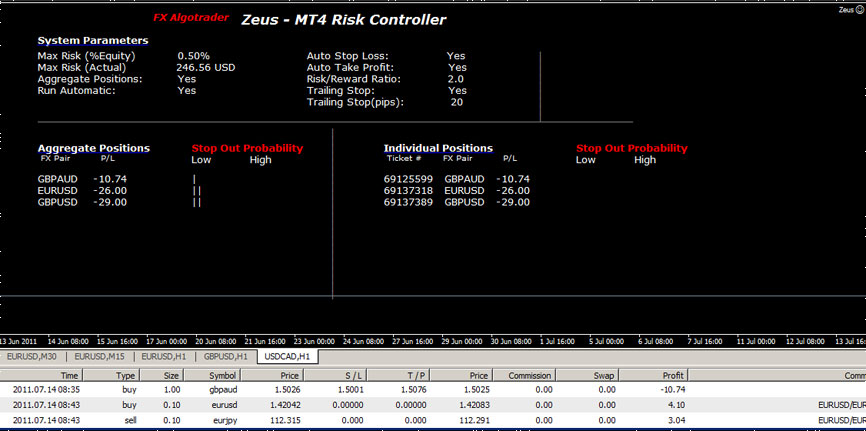

The Zeus Interface

Interface Components

Zeus Risk Controller will also protect your trading account from the following trader imposed account threatening conditions:-

| Over leveraging |

| Inability to accept a loss |

| Paralysis from "falling in love" with losing positions |

| The HOPE strategy - (not normally a good one!) |

| Over trading after a big loss and making an even bigger one! |

| Desperation - 'all in' / 'everything on Black' / 'double or nothing' |

| And a host of other market induced psychotic, account threatening trading behaviour |

When action is required to be taken - the Zeus Risk Controller takes it automatically.

|

$64.95 USD One Time Fee with free Technical Support (no ongoing charges) |

Supporting Products:

Short term forex traders would benefit from enhanced asset selection when using MA crossovers. Products such as the Index Analyzer Service, the Range Analyzer or the Generic Index Analyzer all help traders to optimize their forex pair selection and massively reduce the requirements to perform top down analysis on all the major pairs and crosses each day.